Mission

To be the leading company in the Spanish railway sector, with an international industrial presence, recognized worldwide for its capacity for innovation, technology, quality, reliability and the added value of its products and services.

Talgo’s activity is focused on the design and manufacture of top quality trains, as well as the supply and provision of equipment and maintenance services for railway operators all over the world.

The Group’s business model aims to deliver long-term value to its stakeholders. It is underpinned by a solid financial model focused on steadily increasing turnover and maintaining attractive returns for shareholders; and by a sustainable model that maximises efficiency and social commitment while reducing the environmental impact of its activities.

Low capital-intensive model (low investment in fixed assets, high flexibility and outsourcing) and focuses its resources on design, engineering, selective manufacturing of high value-added components, assembly, delivery process and after-sales service.

Talgo outsources most of the supply chain, manufacturing only the essential components related to Talgo specifications and particularities (welding of critical steel and aluminum structure and rolling elements).

The company’s engineers receive all the necessary feedback to improve the technology and design of the components, so that they can incorporate these advances continuously into all trains, both in the maintenance and manufacturing phases.

Selection of potential commercial opportunities, through an exhaustive analysis based on three pillars: attractive margin, contractual scope that provides the necessary guarantees and security and a reasonable cash profile in line with the project’s risk profile.

Nurturing talent and promoting training as a means to improve productivity, to add value to both the employee and the company, to generate a competitive advantage in the market and to create a motivated, responsible staff committed to Talgo’s values.

Decarbonisation, business ethics, safety, reliability and quality define our industrial activity and our management systems. We are committed to sustainability and social responsibility as travelling companions and value drivers of our activity. We conceive and apply them in an increasingly consolidated way.

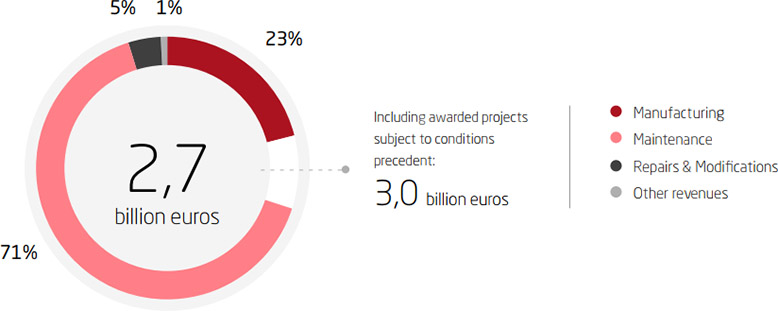

The order book stood at 2.7 billion euros in 2022, reaching 3 billion euros if we include already awarded contracts subject to conditions precedent.

The outlook for the sector is positive, driven by the process of decarbonisation of transport in the coming years and reflected in the expectations of the latest industry surveys.

Still, the current order book offers potential improvements in the company’s two main business lines. Europe, the Middle East and North Africa are the main potential markets for Talgo with additional tenders worth over 5.0 billion euros, mainly in MAV and long distance; 2.0 billion euros in extensions in projects in Germany, Denmark and Saudi Arabia; and an increase in maintenance services activity with the incorporation of new fleets in production over the last few years.

Positive business outlook for 2023 due to decarbonisation of transport in the coming years.

| Millions of euros | 2022 | 2021 | Change |

|---|---|---|---|

| Total order book | 2,748 | 3,249 | -15.4% |

| Order book size: manufacturing | 639 | 976 | -34.5% |

| Order book volume: maintenance services | 1,962 | 2,241 | -12.4% |

| Order book volume: equipment and other | 147 | 32 | 359.4% |

(*) Provided by public bodies.

Manufacturing accounted for 61% of Talgo’s revenues in 2022, calculated on a backbone average, representing 23% of the order book worth 0.6 billion.

The main generators of manufacturing revenues were the projects for DB Talgo 230 (Germany), Renfe MAV powerheads (Spain) and DSB Talgo 230 passenger coach compositions (Denmark).

Although it was a year in which the pace of project implementation slowed down compared to 2021, mainly due to supply chain disruptions. Manufacturing revenue, as a proportion of total Group revenues, remain high due to the impact of Covid-19 on the maintenance business during 2020-2022.

| Scope – €900 million | Status |

|---|---|

|

|

| Scope – €161 million | Status |

|---|---|

|

|

| Scope – €550 million (€2.3 B)(1) | Status |

|---|---|

|

|

| Scope – €152 million (€500 M) (1) | Status |

|---|---|

|

|

| Scope – €157 million | Status |

|---|---|

|

|

(1) Maximum scope of the framework agreement.

(2) Abstract Acknowledgement of Debt, with access to up to 60% of the total value of the contract, which allows for advance payment of the contract.

The maintenance business remained strong in 2022, thanks in part to a strategy based on the use of pioneering technologies that continue to set the industry benchmark. It represented 71% of the 2022 order book and includes services provided to customers in 6 countries with a total amount of 2.0 billion euros. They provide long-term revenue visibility backed by a consolidated and growing maintenance order book.

In 2022, the heavy maintenance and refurbishment business accounted for 5% of the total order book with a total order intake of 0.1 billion euros. It is a business that continues to offer growth potential and is the gateway to new markets.

| Scope – €35 million | Status |

|---|---|

|

|

| Scope – €107 million | Status |

|---|---|

|

|

| Scope – €35 million | Status |

|---|---|

|

|

| Scope – €73 million | Status |

|---|---|

|

|

The 2022 results show the resilience of the business with satisfactory performance even in adverse conditions, while the 2023 forecasts point to expected growth in activity and therefore in revenues with a recovery in margins. The Group maintains a favourable commercial position, especially in the long-distance and high-speed segments in European countries and in the Middle East and North Africa.

The rail passenger transport sector is a key element in successfully addressing the decarbonisation objectives and processes of the proposed global transport system for 2030-2035. This, together with the process of liberalisation of the railway map, means that trade prospects are positive for the coming years.

| 2022 Results | 2023 targets | |

|---|---|---|

| Business performance |

|

|

| Profitability |

|

|

| Capital structure |

|

|

| Shareholder remuneration |

|

|

(1) Does not include R&D projects.

(2) On the order book for the year 2022.

(3) Subject to approval by the AGM. Preliminarily, it will be implemented through a Scrip Dividend and a share buy-back programme.

Talgo, as a leading national and international group of companies in research and development, assigns the highest priority and resources to this essential driver of business value to ensure its continuity and sustained growth over time.

This commitment is also shown by the fact that, despite the results, 18.3% more has been invested in innovation projects over the course of 2022, totalling 16.1 million euros (13.6 million euros in 2021), with R&D expenditure rising to 1.6 million euros, 14.3% more than in 2021.

Despite the decline in results, Talgo invested 18.3% more in R&D projects in 2022 as a factor for future growth.

|

Vittal one hydrogen train

|

Box/light structure

|

|

Light wheelset

|

Viscoelastic panels for structural cushioning

|

|

Metamaterials for interior noise reduction

|

Carbon fibre recycling

|

|

Motorised wheelset

|

|

Box hoist/structure

|

Maintenance 5G

|

|

Improved acoustic experience

|

Indoor guidance using ultrasonic beacons

|

|

Blackout windows

|

Variable frequency dampers

|