Good

Governance

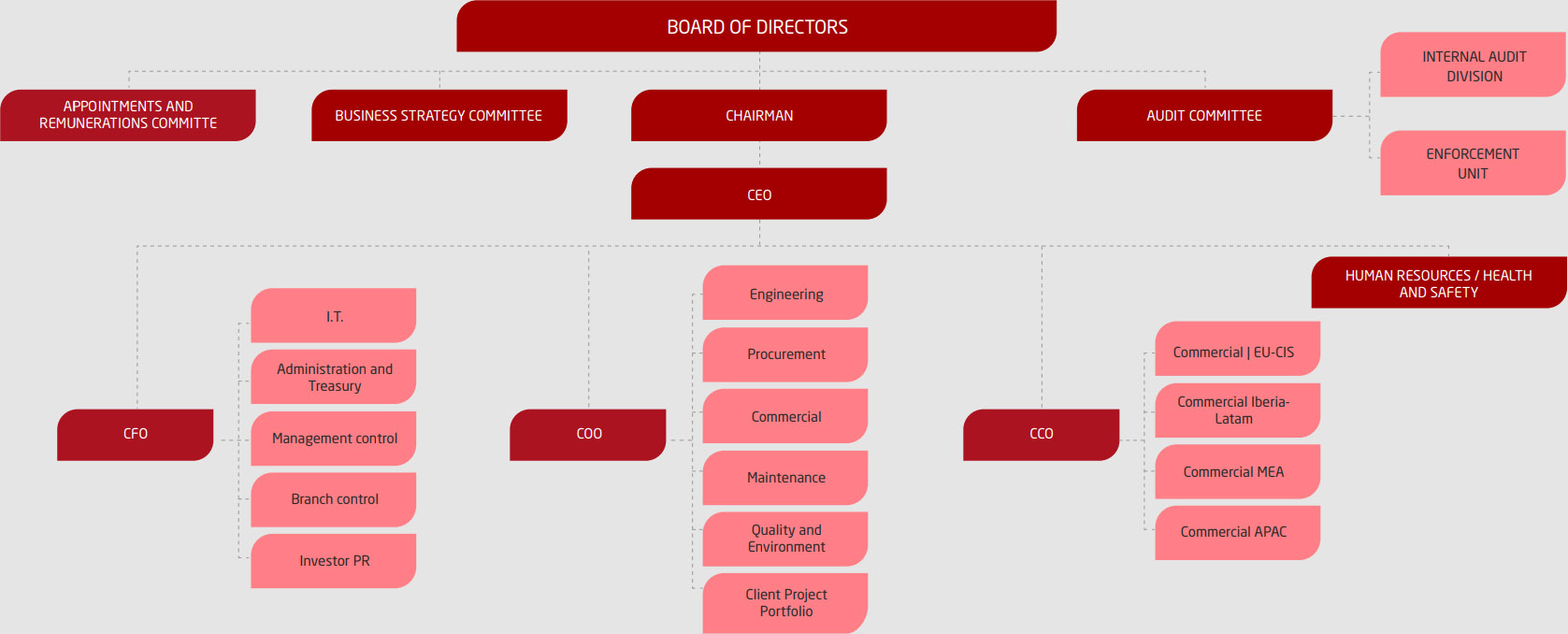

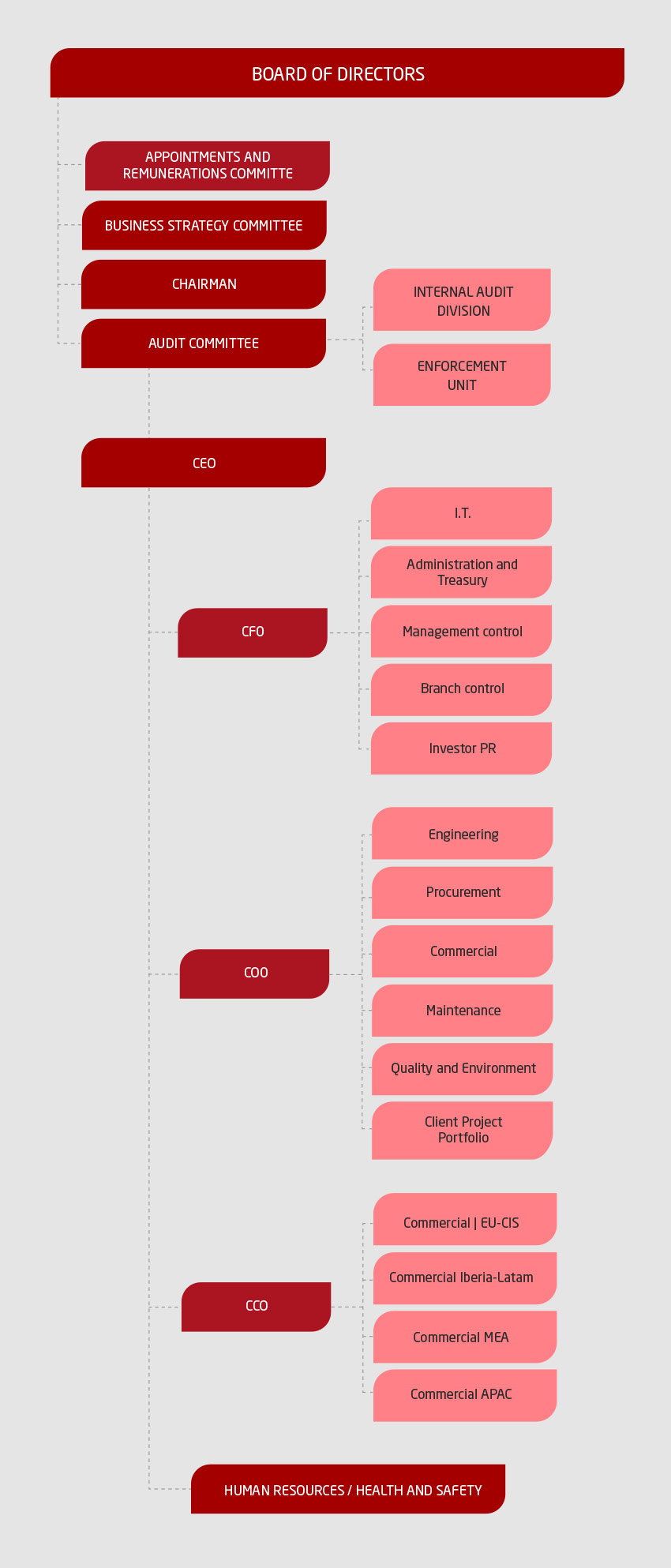

1. Corporate governance structure

The Ordinary General Meeting of Shareholders was held in person and by electronic means on 29 March 2022 on first call, in accordance with the regulations in force at the time of the meeting and was attended by 279 shareholders owning 95,135,654 shares, accounting for 77.069% of the share capital. The final quorum of attendance exceeded 50% of the subscribed voting share capital required by article 193 of the Spanish Limited Liability Company Law, to which article 18 of the Articles of Association refers for the valid constitution of the General Meeting on first call.

Throughout 2022, the Board of Directors of Talgo met a total of 11 times with a percentage of attendance in person of the total votes during the year of 93.4%.

In order to comply with best corporate governance practices, the number of members of the Board of Directors was reduced from 15 to 10 during the financial year 2022. They are re-elected every four years, coinciding with the term established by company regulations.

3. Ethics and compliance

Talgo’s compliance programme is implemented through the Group’s anti-fraud and anti-corruption policy.

The mission of the compliance programme is to contribute to Talgo’s sustainability and good reputation by promoting compliance with all applicable laws and the Code of Ethics, based on an effective risk management system.

The Code of Ethics encourages anyone to report any non-compliance with legislation or internal policies.

The company promotes the use of the Ethics Channel, a confidential system that can be accessed via the company’s intranet or website (www.talgo.com) and which it has outsourced through the company “i2Ethics” to provide it with the greatest independence in management.